Fiji PM admits the Budget won’t win popularity stakes

Tuesday 6 June 2023 | Written by RNZ | Published in Fiji, Regional

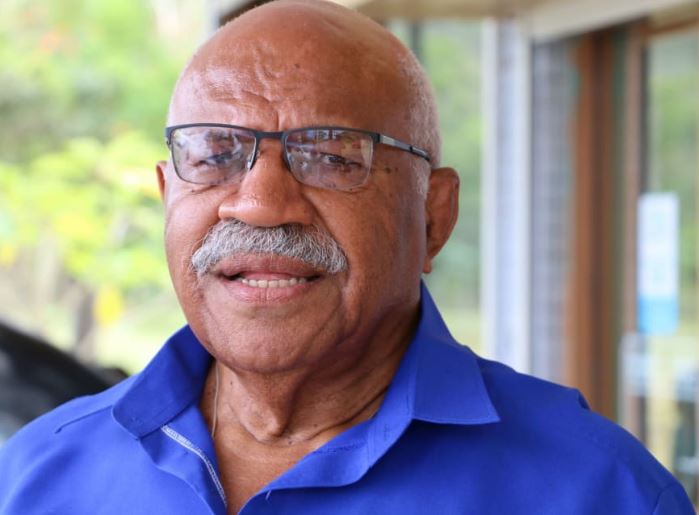

Fiji's prime minister Sitiveni Rabuka. Photo: RNZ / Koroi Hawkins

Fiji's Prime Minister Sitiveni Rabuka has alluded that the upcoming 2023-2024 National Budget will be an unpopular, needs-based one.

The budget on June 30 is eagerly anticipated as it is the first under the new coalition government.

It will outline the government's financial roadmap for the future and deliver on promises made while campaigning for the 2022 election.

"We expect that it will not be a popular budget," the Prime Minister admitted.

"We have to make clear to the people that Government's resources are limited, and as limited as they are, the Government can provide for their needs depending on Government revenue."

The Prime Minister added that the government coffers are "limited by a huge amount" for its debt repayment.

"(We can) not pay it out but will continue with the payment programme."

Fiji is experiencing an unprecedented economic crisis, with the World Bank reporting its debt levels reached 90 per cent of GDP last year.

The country is experiencing high levels of inflation, exacerbated by low economic growth due to the global pandemic topped with multiple severe tropical cyclones.

Deputy Prime Minister and Finance Minister Biman Prasad told RNZ Pacific the budget will put in place measures to best address this economic situation.

"We don't expect to bring down the debt to GDP ratio very, very quickly; it's going to take some time.

"But we have to ensure that we adopt a fiscal strategy which doesn't disrupt the economic recovery as well as create a sustainable level of economic growth in the future to help bring down our debt to GDP ratio," he said.

The goal is to sustain growth in the medium and long term while progressively reducing the debt-to-GDP ratio.

Solutions lie in necessary actions

To raise revenue, the government has identified a combination of tax measures, reduced wastage, and prioritised expenditure in key sectors of the economy.

"First of all, is to look at a very clear fiscal strategy, which means that we are going to look at how we can raise revenue," Prasad told RNZ Pacific.

"But also not just raise revenue, how we can spend that revenue in priority areas such as infrastructure, water, social welfare, and improving the ease of doing business and investment in the country."

With a discussion of tax reforms on the table, Fijians can expect immediate changes to their pockets when the national budget is announced on June 30.

However, Prasad assures Fijians that any tax policies implemented will consider the "welfare of those below the poverty line and on the margins of poverty".

"We will craft a budget that will support economic growth, support investment, but also ensure that we look after our people and cushion the effect of the externally-driven rising cost of living."

Fiji's Fiscal Review Committee, which was set up to develop appropriate expenditure, revenue and taxation regulations for the country, has supported this notion.

Committee chair Richard Naidu said the committee suggests raising revenue through increased tax collections to address the nation's economic woes.

Naidu recommended increasing Value Added Tax to 15 percent and removing zero VAT ratings on basic items.

"We have to re-target that money as it is not just about increased welfare spending, but it's actually targeting those lower-income households and finding a way to deliver cash back to them," he said.

Naidu added that Fiji Revenue and Customs Service is losing $FJ160 million in revenue to zero VAT ratings.

However, economist Neelesh Gounder warned the government needs to also consider socio-economic impacts.

"Any tax reform should look at all the offers on the table. So not just VAT, but personal income taxes, or company income taxes," Gounder said.

"It would be a good idea to put all the taxes on the table and see how we could reform taxes to consider increasing government revenue or creating a more efficient system," he said.

The 2023-2024 National Budget will be announced on Friday, June 30, after which it will be debated and voted in Parliament.