Debate over Pa Enua tax policy begins

Wednesday 1 February 2023 | Written by Matthew Littlewood | Published in Economy, National, Outer Islands

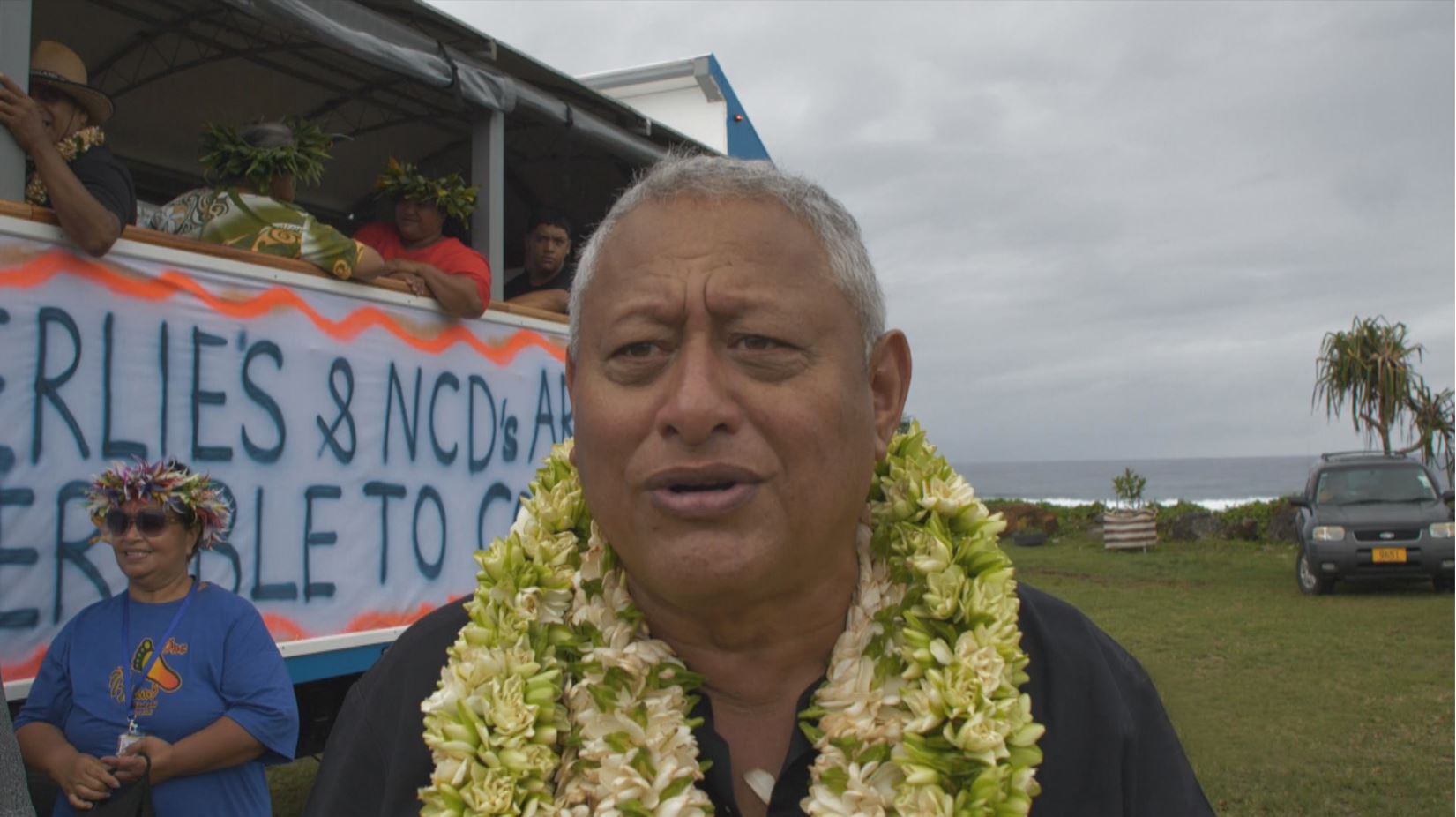

Cook Islands United Party leader Teariki Heather. Photo: SUPPLIED

Pa Enua MPs stand to earn an extra $200 per week thanks to a new Bill that alters the tax-free threshold for those living in the outer islands.

Cook Islands Prime Minister Mark Brown has already told Cook Islands News that one of its first priorities when parliament sits would be to introduce a new Bill raising the tax-free threshold for people in the Pa Enua from $15,000 to $60,000.

According to calculations, this means MPs from the Pa Enua stand to earn an extra $200 per week, while those in the Pa Enua on minimum wage stand to earn an extra $10 per week.

Cook Islands United Party leader Teariki Heather said the policy was “patently unfair”.

“If they’re going to be almost entirely tax-free in the Pa Enua, who is going to pay for it,” Heather said.

Read more: Pa Enua tax relief first order of business: PM

“The policy does not benefit low-wage earners, it is a scam.”

The policy proved controversial during the election campaign, with the Cook Islands United Party filing a petition accusing the Government of bribery, similar to the Cook Islands Party’s free fly-in votes in 1978, which resulted in the Electoral Court declaring the votes of the fly-in electors from New Zealand invalid.

Hearings were held in the High Court in October last year.

However, the petition was dismissed by then-Chief Justice Sir Hugh Williams in November, whose judgement said: “all parties, jockeying for votes, wanted their policies to be publicly attractive, so the notion that the CIP tax policy, as with other similar measures, was motivated by a corrupt intention recedes in credibility”.

Opposition leader Tina Browne, who holds the Rakahanga electorate, said on first glance the tax-free exemption “really didn’t benefit most people in the Pa Enua that much”.

“From my reading, it would only benefit parliamentarians, executive officers, and financial officers in the Pa Enua,” she said.

“For those on minimum wage, which is most of the Pa Enua, it will be of minimal benefit.”

Browne said she would have to look at the Bill in detail before she voted on it, but “if it ends up confirming what I suspect, which is that it benefits very few people in the Pa Enua, then I couldn’t in good conscience vote for it”.

“However, if the Bill is targeted at lower wage earners, and not parliamentarians like ourselves, then I would be open to discussion,” Browne said.

PM Brown was unavailable for comment on Tuesday.

However, in an interview with Cook Islands News last week, he said this threshold will be under constant review, as things like minimum wage increase.

“The last major tax reform in 2014 was a result of people earning more money, and therefore paying more tax. It’s something called tax creep,” Brown said.